So I have been given a raise. I accepted it, along with heaps of praise, because to not accept it would arouse suspicions. While I fully believe in arousal, I prefer my suspicions to be had before and after work, much like bowel movements.

As much as editing business material can be dull, I did have a rather interesting discussion with a man I believe I would be correct in calling a genius.

We’ll call him Peter. Peter is a legend in the financial world for writing engaging, thought provoking pieces on global events and how these events are interrelated, their ramifications, and how to predict various fallouts and benefits to be had by tracking them. Then he deciphers their meaning. He is a serious man, but engaging and pleasant, a very strong twinkle in his ‘glad to be alive’ eyes. The kind of man you want to have at your salon (no, I don’t cut hair or do nails).

He wrote a piece on how ‘the Princess Bride’ was really a treatise on the benefits of the gold standard. It was incredibly convincing and I do not doubt for a moment that the fairy tale (condensed in the film version) was indeed about money.

Peter is an artist with a gift for making money, or making others money by predicting changes and trends in world markets. And he makes a lot of people a lot of money by doing what he does.

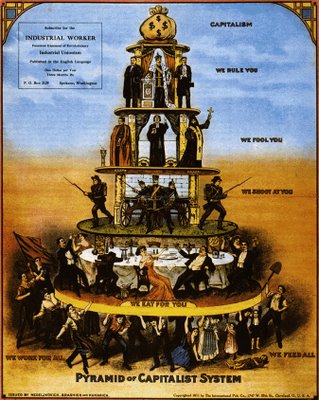

Some of the junior Peter’s in my office were reading Ayn Rand’s ‘Atlas Shrugged’, a large treatise on the benefits of godless capitalism, or individualism. This book is standard reading at my office. Not only is it read by all, but the philosophy established by Rand in this book (objectivism) is their religion, and I don’t use that term lightly. They are objectivists to the same degree that there are Christians.

As an example, one of the discussions to evolve from the book was the idea that people in wheelchairs who do not-much and watch television are worthless. (I countered that, without them, the creative people that are making television for wheelchair-bound watchers aren’t able to make a living, but the objectivists were not to be deterred, so I countered with, what if you send the non-creative, non-contributing members of society to a place where they are left to fend for themselves, or to labour camps (it’s a slippery slope), and then one of them has an idea that will forever alter our world for the good, but the opportunity is gone? – they, again, were not to be deterred from their belief that selfishness is the way to cure mankind’s ills).

So we were discussing this book (read: me arguing with them), and I was saying that, in our society, as in most on earth, we value human life above all other rights (I will not enter an abortion debate here, however). So, if that is the case, and we live in a free market economy, why do doctors make less than your standard CEO? Do we value doctors less?

This is where Peter walked into the conversation. He said, ‘I have always wondered why doctors make less than investment advisors. Is it simply a matter of time before the market corrects itself?’.

To paraphrase some more, Peter felt that money is pure, that it has no bias, that it finds its own level, and that therefore, either doctors will end up getting paid more eventually, or the market IS accurate, and investment advisors are worth more.

I suggested that, perhaps because investment advisors help to create wealth, they also save lives indirectly, ie – a family comes to Canada, invests their savings, and sends their children off to university, and they have families, and they invest, and they raise their family lineage out of poverty and into comfort and health, via wealth (the correlation between the standard of living and quality of life, life expectancy, and infant mortality rates is irrefutable, but refute if you feel like it).

Perhaps the investment advisors along the way have saved the lives of generations of this family. Perhaps this is why they are rewarded more than doctors. Peter thought that this was a fair assessment and probably explains the discrepancy between salaries.

Upon reflection, I’m sure that there are examples of investment advisors who err, who make mistakes, who cost lives indirectly… but I couldn’t shake Peter’s notion that money is pure – it does not play favourites.

The doctor makes less than the advisor because the large scale effects of their efforts are different. No, not on an individual basis if a doctor has saved you or a family member’s life, but on a macro view (and money is both macro and micro, although we’re dealing with its aggregate cumulative effect and resulting compensation/valuation) advisors do more good than doctors.

I did, however, come across a glitch that Peter didn’t mention: perhaps money isn’t pure, but it carries with it the bias of those who agree to trade it.

Perhaps we value our collective amount of money more than we value our collective of people, and that is why the advisor earns more than a doctor, a teacher earns less than a street car driver, a marketer more than an airline pilot. I can't get, save, spend, earn your life, but i can get, save, spend, and earn your money. the person affects the outcome.

Meaning: money ends up valuing money. That is the inherent bias. Money is alive, possessing the same self-replicating desires as humans, the evolutionary process completed by humans in its quest to make more of itself. it is alive because it does not die without you, it has a symbiotic relationship with you, it needs you like you need it. in the collective pysche, it will be kept alive. you cannot stop it.

In this sense, Money acts as a virus.

And so a human infected by money ends up valuing money more than humans because the money, as a concept, is a commonly understood means of survival - the seflish human needs the pure money. the selfish human needs to help money replicate. those who help money replicate are worth more than other people because they keep me alive longer.

money is the doctor to my time on earth.

A stretch?

Perhaps. But it would explain why we pay Peter C$1,700,000 every 12 months, whereas we pay a heart surgeon less than 1/3 of that amount to literally take your life in her hands in a way that Peter never ever ever will.

I’m not sure either way. Both argument are compelling, and I’m sure there are more. But as it stands right now, it seems that our society views individual wealth creation more than anything else because it keeps us alive

And Ayn Rand, the destroyer, the selfish, is laughing all the way to her godless rotting hell.

2 comments:

Doctor's work for the Government, so WE pay them. They are not part of the free market. Investment advisor's work for themselves/banks and choose/create their own salaries.

Don't forget that a Hot Dog Vendor gets all the hotdogs he wants, a Brewmaster gets all the beer he wants, likewise a Doctor gets all the doctoring he wants...and financial genius' get all the financing they want. makes sense...

h

doctors can move, they are desired globally. those that move to the US find that my scenario holds.

also, a financial genius doesn't set his own salary. a hot dog vendor gets all the hot dogs he wants only if he is the owner. likewise with the brewer. a financial genius works for a company, and does not get to 'eat' as much as he likes unless he wants to be fired.

Post a Comment